Be Debt-Free, Save Money, Invest & Retire

Learn intelligent strategies to grow your wealth in Canada.

Investing

Have some extra cash burning a hole in your pockets? Use your equity to create more wealth for yourself through investing. Every day your money loses value when it’s not in the market. Learn how to invest and get your money working for you!

Investing Articles:

How to Invest for Beginners

How to Buy Stocks in Canada for Beginners

Best Long Term Stocks to Buy & Hold

What is Market Capitalization?

ETF vs Index Funds

Personal Finance

- Save Money

- Get Rid of Debt

- Smart Spending

- Making More Money

About Us

Money, Eh? was created out of the need for a resource which provides the average Canadian with an education on growing wealth and personal financial health.

Financial literacy is a powerful skill which provides long-term prosperity.

Learn our trading strategy.

There are so many options for investing available, how do you choose? Learn our strategy; from the basics of trading to how we pick our investments.

- What ‘s trading all about?

- Terms to know

- How to open an account and place trades

- How to find and choose stocks for yourself

- Our stock recommendations to get you started!

Canadian Stock Lists

Recent Posts:

Mastering Passive Income Strategies in Canada

Emerging financial trends and digital advancements have opened up a myriad of opportunities for investors seeking to generate passive income in Canada. This tree of

Exploring Average Net Worth in Canada by Age Group

In the intricate landscape of personal finance, net worth serves as a crucial barometer of financial health. Focusing on the Canadian context, this investigates its

Exploring Secret Shopper Jobs in Toronto

Whether you’re seeking a flexible job option, an exciting new side gig, or a unique way to influence and enhance the consumer experience, becoming a

Best Payday Loans in Ontario: A Detailed Overview

Set against the vast tapestry of Ontario’s thriving economic landscape, the nexus of payday loans presents a piquant study. This intricate niche of short-term borrowing

Spotlight on Canada’s Cheapest Tesla Model

As we steamroll into a future dominated by electric vehicles, Tesla remains at the forefront, setting unprecedented standards in electric car technology. As a keen

LoansCanada.ca Review: A Detailed Examination

In the ever-transforming digital sphere, the realm of online loan platforms has burgeoned with potential and diversity. Amidst such online lenders, LoansCanada.ca has established itself

How to Send Money from Canada to the US

Are you a Canadian resident in need of sending money to the United States? Whether for business purposes, supporting family members, or simply making international

Most Affordable Places to Retire in Canada

Retirement is a significant milestone in life, offering the freedom to pursue passions, explore new hobbies, and enjoy a relaxed pace. When planning for retirement,

Best Mystery Shopping Jobs in Canada

Do you want to get paid for shopping and dining out? Mystery shopping might be the perfect gig for you! As a mystery shopper, you’ll

The Influence of Personal Debt on Entrepreneurial Ventures: Harmonizing Individual and Enterprise Finances

The pathway to entrepreneurship is often brimming with potential rewards but also fraught with financial challenges. A critical consideration that many budding entrepreneurs grapple with

Survey Junkie Review Canada

Do you love taking surveys in your free time? Are you looking for a way to earn some extra cash? Then, Survey Junkie might be

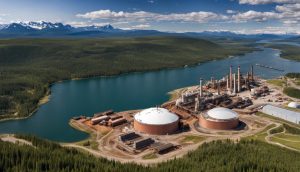

Energy ETF Canada

With the ever-increasing demand for energy, investing in the Canadian energy sector can be a profitable venture. However, selecting the right investment vehicle can be

Leasing Vs Buying A Car In Canada

Are you in the market for a new car in Canada? One of the most significant decisions you’ll have to make is whether to lease

How to Save for Your First Home Down Payment in Canada

Are you dreaming of owning your first home in Canada but struggling to save enough money for a down payment? You’re not alone. Saving for

What is the First Home Savings Account (FHSA)?

Are you a first-time homebuyer in Canada struggling to save for a down payment? Have you heard about the FHSA but don’t know what it

Cheapest Electric Car Canada

With the increasing popularity of electric vehicles in Canada, many consumers are looking for affordable options that fit their budgets. Fortunately, with government incentives and

Simplii vs Tangerine

Are you looking for a new bank in Canada? With so many options available, it can be overwhelming to choose the right one. That’s where

Best Scotiabank Credit Card

Are you a Canadian looking for a credit card with great rewards and benefits? With so many options available, it can be overwhelming to choose

What Happens to Stocks When Interest Rates Change?

Understanding the correlation between interest rates and the stock market is crucial for investors. Fluctuations in interest rates can affect the value of your investments

Credit Cards With No Foreign Exchange Fees Canada

Are you tired of paying extra fees when using your credit card abroad? Foreign transaction fees can add up quickly and put a damper on

MoneyEh is here for you.

If you have any questions about the site, the content or for our experts, please drop us a line and we will respond as soon as we can.