3 Reasons why Ayurcann Stock Is a Must Have

Written By: Marc Challande

Published : February 2nd, 2022

At first glance, you might be wondering why Ayurcann stock (AYUR.CN) should be part of your portfolio and you are in the right. For the last year, the stock price remained pretty steady and it is very positive if we compare it to the sector downtrend. Besides, it doesn’t mean no work was done in the background. I am talking about one of the most undervalued companies in the cannabis sector. Their recent news releases are convincing and the Company is definitely ready to ramp up.

A Huge Market Opportunity

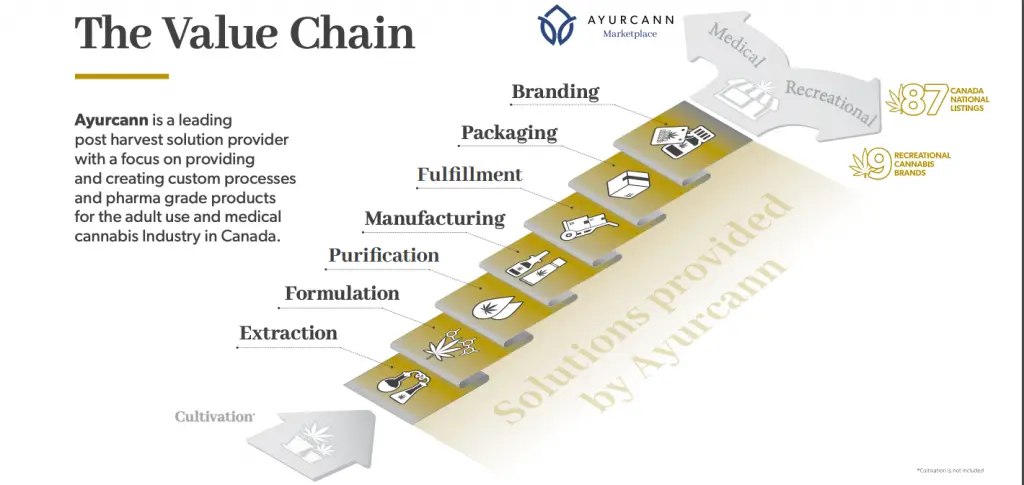

Ayurcann is a leader in the post-harvest solution provider and aims to provide, create custom processes and pharma-grade products in Canada for adult use and the medical Cannabis industry. Ayurcann is working hard to become a partner of choice for leading Canadian and international cannabis brands by providing 1st choice products, proprietary services including extraction, formulation, product development, and custom manufacturing. As you may understand, the Company wants to be on the leading front of the Cannabis sector, and this sector is in fast expansion.

Investing in Ayurcann means you will be involved in one of the hottest sectors for next years. The whole Canadian cannabis market was representing $3.1B in 2020 and is supposed to reach $10.1B by 2025. Ayurcann already has 87 national category listings, 6 recreational brands, and 3 medicinal brands.

The Company is doing everything from A to Z and this is extremely valuable. They have a capacity of over 300,000 kg of extraction & refinement, and offer extraction and refinement services including bulk extraction, winterization and fractional distillation.

Strong earnings/Fundamentals

Ayurcann has 3 Consecutive quarters of positive EBIDTA and cash flow. If we focus on their last earnings, they reported $7M in total assets for only $2M in total liabilities and Ayurcann is proudly debt free. To convince you more about this company, let’s highlight these numbers:

AYUR reported net revenues of $1.9 million for the three months ended September 30, 2021, compared to $0.8 million for the three months ended September 30, 2020, an increase of 137% YoY.

The Company reported gross margins of $931,000 for the three months ended September 30, 2021, compared to $169,000 for the three months ended September 30, 2020, with gross margins of 49%, maintaining strong control over sales and profitability.

Investors are always looking for emerging companies that are able to generate a positive cash flow and EBITDA. In this sector, not many companies can boast to have it. Ayurcann is an exception and these data definitely bring more value and show the company has a strong financial position.

“We are thrilled to see our revenues grow at a steady pace while maintaining incredibly strong margins and running a profitable business. We can confidently say we are profitable now and fully expect to show continued profits going forward while building on our momentum.”

Mr. Sudman , CEO

The Company keeps on moving forward as proved in their recent news release. Indeed, the Company announced they would enter into a Canadian provinces (Alberta) with the launch of their high potency THC branded “Fuego” vapes. They are also implemented in NB, MB, SK, and ON which leads the Ayurcann to its 5th province. There is strong competition in Canada for the THC sector, and Ayurcann is definitely one of the leaders in this race.

Share Structure

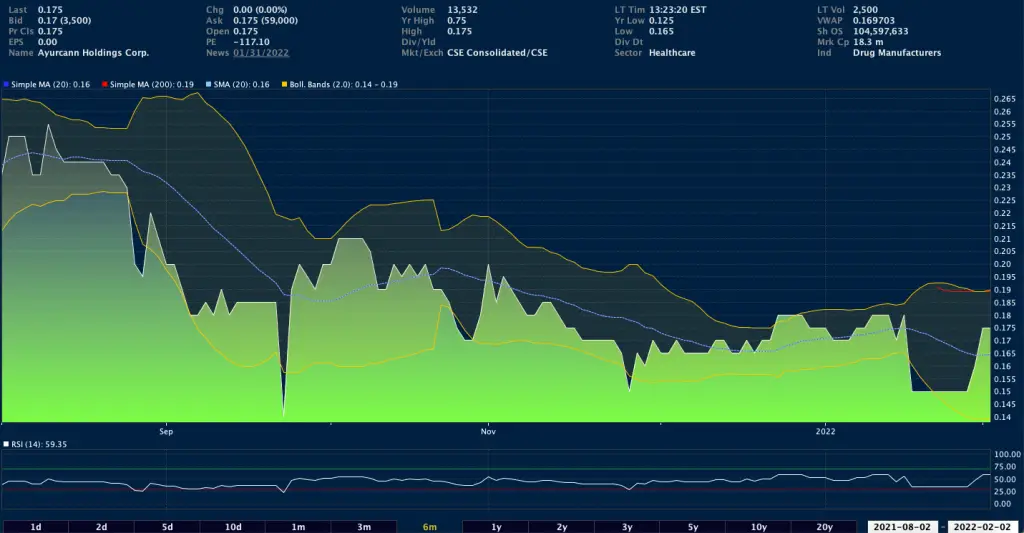

Ayurcann Stock is currently traded at $0.165 for a market cap of $16M. When I was talking about the Company being undervalued, its P/S ratio is definitely low. With a ratio of 1.69, Ayurcann’s is the lowest compared to its peers (Medipharm=2.03, Pure Extracs=25, Neptune Wellness= 1.73).

The stock price saw a lot of fluctuations for the last year as it went as high as $0.75 (IPO) and is now closer to its 52-weeks low of $0.12. If we don’t focus on the IPO initial price, the company is facing well the whole market downtrend. The Bollinger bands indicate us we could see daily fluctuations between $0.14 to $0.19. What could lift the stock price up would be good news. As the stock doesn’t move up or down with the general market, it means that good news, earnings will be the main catalysts. Moreover, its RSI level indicates it is neither in overbought nor oversold territory, reducing the risk of big varations, and so leading for a good time to invest in.

There are 120,932,413 shares outstanding and 18,328,194 reserved shares for insurance. Warrants have a weighted exercise price of $0.20 and options have a weighted exercise price of $0.17. We shouldn’t see much dilution as the insiders are buying shares

Bottom Line

Ayurcann’s background is more than convincing. Their earnings show where the company is heading, and a lot more will come throughout the year. Indeed they plan to do the launch of XPLOR branded medical products, distribute for brand partners, and increase x3 manufacturing capacity during Q2/Q4. AYUR deserves to have more spotlights as the Company’s fundamentals are strong, the management board is acting fast, and in case you missed it, Yahoo Finance gave a 1-year price target of $0.55. Having Ayurcann stock at least in your watchlist is a must if it is not already in your portfolio. To end this article, I would like to highlight what the board said:

“We are confident in extracting value for our shareholders and gathering market share in the industry. We are confident that we will continue securing additional supply and manufacturing agreements with top-tier customers across the country, helping grow our top-line revenues.”

Ayurcann’s board knows the way to go to succeed and it is more than exciting to know they want to share their success with their shareholders.

This article solely expresses the opinion of the writer which might be disagreeing with the other writers of Money,eh?. Moreover, the writer isn’t involved in AYUR, and doesn’t own shares of the Company.

ayurcann stock ayurcann stock ayurcann stock ayurcann stock ayurcann stock ayurcann stock ayurcann stock ayurcann stock ayurcann stock ayurcann stock ayurcann stock