Enterprise Group Released Great Earnings!

Written By: Marc Challande

Published : February 12th, 2022

Enterprise Group (E.TO) is a consolidator of services-including specialized equipment rental to the energy/resource sector. The Company works with particular emphasis on systems and technologies that mitigate reduce or eliminate CO2 and Greenhouse Gas emissions for itself and its clients. The Company is well known to local Tier One and international resource companies with operations in Western Canada. The Company released unaudited numbers and they definitely show Enterprise group is on the right track.

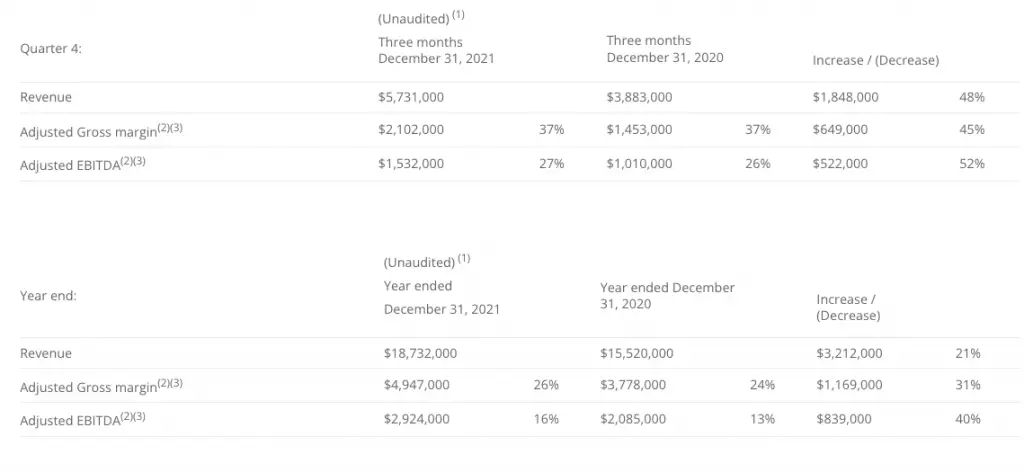

“Our unaudited numbers show that Enterprise delivered a 48% revenue increase in Q4 and a 21% increase for FY21,” stated Leonard Jaroszuk, President & CEO. “Our aggressive growth plans going forward will build on initiatives commenced in 2021 with significant development in the area of cost-effective solutions to markedly reduce greenhouse gases for our clients’ projects, including our numerous Tier One customers, two of whom were recently announced.”

- Revenue for the year ended December 31, 2021 was $18,732,000 compared to $15,520,000 in the prior year, an increase of $3,212,000 or 21%. Adjusted gross margin for the year ended December 31, 2021 was $4,947,000 compared to $3,778,000 in the prior year, an increase of $1,169,000 or 31%. Adjusted EBITDA for the year ended December 31, 2021 was $2,924,000 compared to $2,085,000 in the prior year, an increase of $839,000 or 40%.

- During the three months ended December 31, 2021, the Company purchased and canceled 627,500 shares at a cost of $191,000, reducing the share capital account by $893,000. For the year ended December 31, 2021, the Company purchased and cancelled 2,034,500 shares at a cost of $508,000, reducing the share capital account by $2,904,000. Since the initiation of the share buyback program, the Company has purchased and cancelled 8,094,000 shares at a cost of $2,388,000 and as a result, the Company’s share capital account has been reduced by $11,464,000 over the entire share buyback program. Enterprise believes its stock remains undervalued and will continue to re-invest positive cash flow to buy-back shares to enhance shareholder value.

- The Company has benefited from the Canadian Emergency Wage Subsidy and Rent Subsidy Programs (“CEWS” and “CERS”) which ended in October 2021. To provide further comparability to pre-Covid operations, the Company has presented Adjusted Gross Margin and Adjusted EBITDA to reflect the results without any subsidy programs. Utilizing the CEWS and CERS programs, the Company recorded $28,000 ($334,000 – December 2020) against direct costs for the three months ended December 31, 2021, and $32,000 ($392,000 – December 2020) against Adjusted EBITDA for the three months ended December 31, 2021. Utilizing the CEWS and CERS programs, the Company recorded $1,649,000 ($1,417,000 – December 2020) against direct costs for the year ended December 31, 2021, and $1,909,000 ($1,619,000 – December 2020) against Adjusted EBITDA for the year ended December 31, 2021.

Share Movement

With the recent news announcing a supply and services contract with a global Tier One client, and the strong earnings, the share price leveled up to hover around $0.40, is currently 26% above the last consolidation, and 90% up Yoy! The recent sell-off hasn’t scared investors and we could see consolidation around $0.38, data supported by the VWAP (Volume Weighted Average Price) at $0.385. The stock is still clearly on an uptrend with the Simple MA (20) at $0.38 being way above the Simple MA (200) which is at $0.33.

The volume increased for the last couple of weeks:

-Average Volume (50 days): 52k;

-Average Volume (30 days): 65k;

-Average Volume (20 days): 75k;

-Average Volume (10 days): 119k.

Despite the recent sell-off, investors weren’t willing to sell their shares, only 50k shares were traded on Friday, February 12th and investors allowed a small pullback of -1.30%.

The Bollinger bands indicate us we should see daily variations between $0.37 to $0.40. It should be a good time to add more shares during this phase.

Bottom Line

Enterprise Group keeps doing great management and their financials reflect it. Their business is growing, and they keep on canceling shares through a buyback program. The stock appears to be a safe value during the current times, and investors understood it. The next earnings will be definitely and will bring the Company to an upper valuation.

This article solely expresses the opinion of the writer which might be disagreeing with the other writers of Money,eh?. Moreover, the writer isn’t involved in E, and doesn’t own shares of the Company.

enterprise group enterprise group enterprise group enterprise group enterprise group enterprise group