Ese Entertainment, the Best Esport Play for 2022

Written By: Marc Challande

Published : February 4th, 2022

Ese Entertainment (ESE.V) is one of these promising stocks to own for the future. Thanks to its great management and the booming Esport sector, Ese Entertainment is set to become a leader in the industry. Indeed, the stock is currently up by more than 500% since its IPO (August 21st, 2020). Ese Entertainment combines multiple gaming and esports assets to create a single world-class brand. ESE also operates its own e-commerce channels, esports teams, and gaming leagues

A Company in the Right Sector

The Esport industry is growing fast. The total revenue for the sector is supposed to reach $1,790M for the year 2022. To convince you more about the rapid expansion of the industry, its CAGR (Compound Annual Growth Rate) represents +22.3% between 2017 to 2022.

Regarding the Company, Ese entertainment was created in 2019 and the only thing we can say is the Company didn’t rest. ESE has a TV deal with Polsat (a company valued at $6B) for its participation in the Ultraliga Esports Event. Ultraliga had over 24 million viewers tune into its esports channel. They also have famous customers such as Porsche and Orlen with who they manage and run certain gaming and esports events on their behalf, with a focus on simulation racing.

Recently, ESE announced a partnership with Skinwallet and New Business Division to enter Metaverse with gaming and Esports projects. Metaverse brings a lot of opportunities and the Company is making all the right movements to be well-positioned for the future.

Fundamentals

In their last financial statement released in September 2021, ESE revealed a strong balance sheet. If we focus on their numbers, the company had $9M in cash for only $1.3M liabilities. Moreover, this statement proved the Company is having a fast growth:

$4,234,984 quarterly revenue with over 400% increase over the prior quarter

-

Quarterly revenues of $4,234,984 (gross profit of $448,505), compared to $138,035 in year prior (2020);

-

Total assets of $13,960,781, compared to $842,093 in the year prior (October 31, 2020).

The Company had $3,786,479 in cost of sales. They also shared a basic and diluted loss per common share of $0.02 (total comprehensive loss for the period of $1,258,610) but it is very common for emerging companies to not have positive earnings as they have to have bigger expenses to expand fast.

This data doesn’t include their latest acquisitions’ revenue which will improve very significantly their balance sheet.

“Last year we executed on our M&A strategy with a total of four acquisitions completed. This has set a new base of operations for the company and put us in a stronger operational position. Throughout our acquisitions processes, our aim has been to structure deals with shareholder value at the top of mind. This focus will not change, and our M&A team intends to continue to pursue synergistic acquisition targets in 2022.”

Konrad Wasiela, CEO

So far, ESE has completed four acquisitions: K1CK Esports in January 2021, WPG in April 2021, Auto Simulation Limited T/A Digital Motorsports in September 2021, and Frenzy sp. z.o.o. in November 2021.

Share Structure

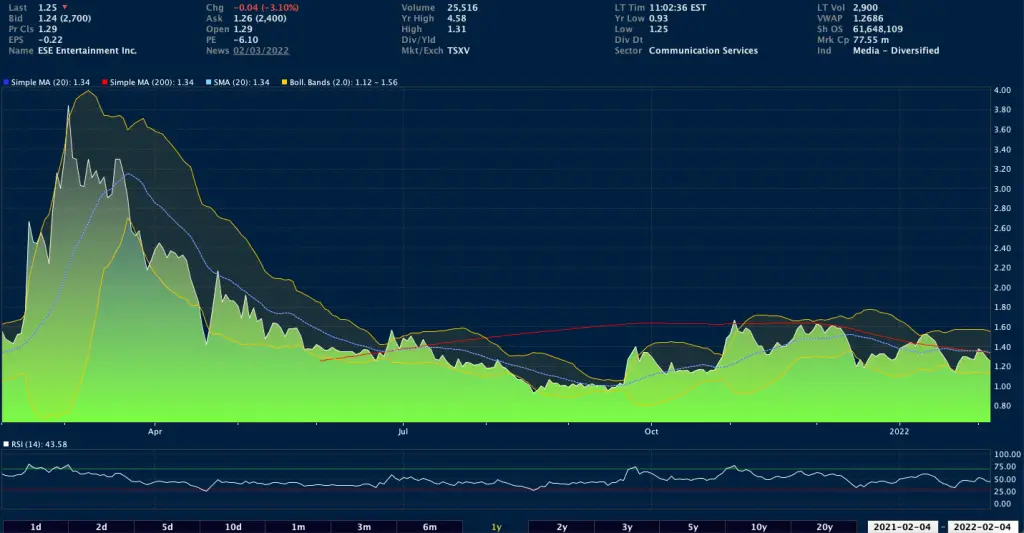

The stock is currently traded at $1.26 for a market cap of $75M. It saw a lot of fluctuations for the last year with an all-time high of $4.58 (March 2nd, 2021), and now is closer to its 52-weeks low of $0.93 (August 19th, 2021). The downtrend is explained by several reasons including the fact that most of the emerging stocks underwent a harsh slip and went back to their fundamentals. Since then, the stock faces well the overall bearish sentiment as the stock is up by 34% since August.

Furthermore, with a P/S ratio of 14, ESE’s value is amongst the lowest of the Esport sector. As a comparison, FANS’ ratio is at 18, EPY’s ratio is at 219, LUCK’s is at 434!

We can determine the stock price thanks to several key data. The Bollinger bands indicate us we could see daily price fluctuations between $1.12 to $1.56. Right now, the Simple MA (20) joined the Simple MA (200), meaning we could have a potential uptrend as investors usually wait for this signal to invest in. Any significant news or sector movement will propel the stock price as ESE.V stock is one of the most-watched stocks of the sector.

ESE has only 75M shares fully diluted (8M warrants and 4M options) . If you are not familiar with this data, this number is incredibly low for an emerging company. It ranks the Company with one of the lowest floats amongst other sector peers. The public float represents only 33M shares and insiders own around 40%. Once again, these data are astonishing and prove the Company has a great share structure.

We could potentially see more dilution. It will be interesting to see how ESE will acquire news assets if they do it just through shares offering, shares+cash, or only cash.

Bottom Line

Ese Entertainment is set to become a leader in the Esport sector. The Company has built great foundations in a very short amount of time and a lot will come in the future. Let’s not forget many more catalysts are coming including entering Metaverse, iGaming, and the acquistion of news assets to have an organic asset growth.

Their next earnings will definitely be more than exciting and will show the real value of ESE. If you haven’t done it yet, you must add this company to your watchlist, and if you want to invest in a promising sector with great fundamentals and a great future, ESE.V is the one for you.

This article solely expresses the opinion of the writer which might be disagreeing with the other writers of Money,eh?. Moreover, the writer isn’t involved in ESE, and doesn’t own shares of the Company.

ese entertainment ese entertainment ese entertainment ese entertainment ese entertainment ese entertainment ese entertainment