What is a Dividend Stock ?

Written By: Marc Challande

Published September, 5th 2021

Have you ever heard about a dividend stock ? These mesmerizing stocks give you monthly cash or additional stocks. Indeed companies, for a variety of reasons that we will se later, grant a “reward” to their investors for good and loyal service to be invested in their companies. Some informations might be tricky to analyze dividend data so let’s take a look on how to analyze them.

How do dividends work

A dividend is a reward from a company to their investors. In most of the cases, a part of the companies’ net profit is taken and then distributed to their shareholders. Even if a company isn’t profitable, they will pay dividends to show their sustainability and to keep them a track record of scheduled payed dividends. Dividends are clarified by a company’s board of directors and the stock price may vary depending if the dividend’s worth is augmented or reduced. Besides, a lot of companies don’t give dividends to keep the net profit reinvested into their company. The board of directors will also choose the timeframe for the dividends. It can be monthly, quarterly or annually.

What Sectors pay Dividends ?

Established companies with more predictable profit are the best ones to give dividends. Some industries are generally more likely to pay dividends:

- Basic materials (WestBond Enterprises , KP Tissue Inc…)

- Oil and gas ( Orca Energy, Canadian Natural Resources…)

- Banks and financial ( National Bank Of Canada ,Royal Bank Of Canada…)

- Healthcare and pharmaceuticals ( Extendicare, Sienna Senior Living…)

2 other great sectors that can generate good dividends are real estate investment trusts (REITs) and companies structured as master limited partnerships (MLPs).

So why a lot of companies don’t pay dividends ? Start-up and other high-growth companies, such as the tech companies or the ones in biotech sectors, may not offer regular dividends. Indeed, these companies need to use all their resources to grow fast. They generally use cash in marketing, research, business expansion…

Even profit-making early- to mid-stage companies usually don’t pay dividend as they are eyeing for a higher growth and expansion. They would rather reinvest their profit in their company than paying dividends.

What are the Dates/Numbers to Know ?

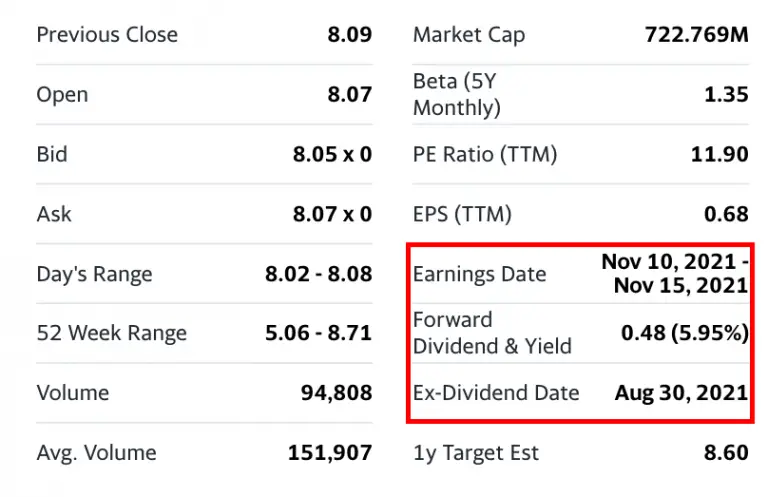

When you look for companies with great dividends, you should always take a look at these dates and numbers:

- Announcement date: dividends are announced by the company management on the declaration date and has to be approved by shareholders before they can be paid;

- Ex-dividend date: The “last call” for shareholders to get a stock for earning dividends. For example, if a stock has an ex-date of July, 14th, shareholders have to buy the stock before this date. If they get the stock this day or after, they will not be eligible to dividends;

- Record date: it’s a cutoff date, which means the company determines which shareholders are eligible to receive a dividend;

- Payment date: the grace day, when the shareholders get the dividends issued by the company.

- Dividend yield : What % of the stock price is given into dividends. For example, a company which has its stock price worth $100 and give $2 dividend for each stock will see their dividend yield at 2%. This percentage varies depending the stock price. If the SP goes to $80, the dividend yield will reach 2.5%.

Can Dividends affect a Stock Price ?

As we said earlier, augmenting or reducing dividends can drastically affect a stock price. During the pandemic, oil companies weren’t spared. The best example is Occidental Petroleum which was well know for having a high dividend yield. Because of the lockdown, restrictions, the company really suffered and lost a lot of money. As a consequence they just gave a penny for each share. Right after, the oil and gas producer’s shares fell 5% to $12.95.

Why do Companies keep Giving dividends ?

There are several reasons why companies keep giving dividends. As we mentionned earlier, dividends can be expected by the shareholders as a reward for their trust in a company. They help to maintin investor’s trust and they are preferred by shareholders as they are treated as a tax-free income in a lot of countries. A high dividend yield and declaration can indicate a company is doing well and generates good profits. But it also indicates the company isn’t targeting a fast growth because the cash they have is used to give dividends instead of being reinvested.

Bottom Line

Dividend stocks are a great way to have a passive income. Your stocks should go up AND they give you money back. It won’t be this type of stock with a huge growth, but it is always good to have them in your portfolio to diversify it.

dividend stock dividend stock dividend stock dividend stock dividend stock dividend stock dividend stock dividend stock dividend stock dividend stock dividend stock dividend stock