3 Good reasons why to buy Powerband Stock

Written By: Marc Challande

Published August, 26th 2021

If you had bought Powerband Stock (PBX.V), a company based in the automotive technology, a year ago, you would have enjoyed already a whooping 500% return, and from the last month a 44% return on investment. To clear some thoughts about this company, we give you 3 good reasons why Powerband Solutions is a buy.

An Emerging Market for Powerband

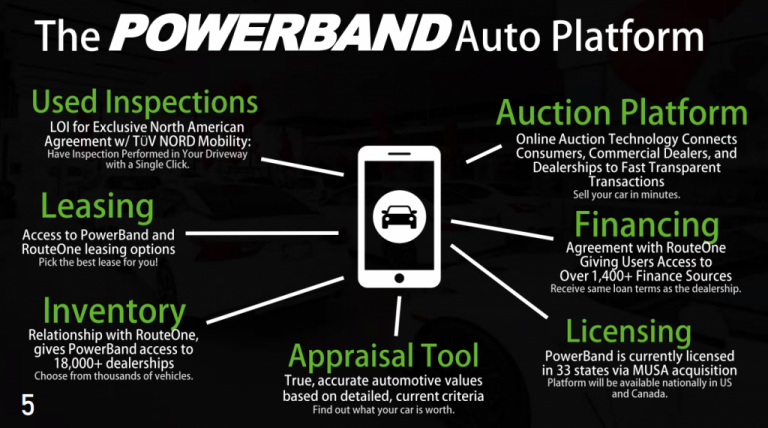

Powerband’s goal is pretty clear to understand: revolutionize how the world buys, sells, leases, finances and trades in cars, trucks and other vehicles. They step in a US$1.2 Trillion sales ( New cars represent US$363B and Used ones represent US$841B). Where can they get their niche ? E-commerce in this market only represents 1% of the market penetration. In comparison, apparel, footwear and appliances respectively represent 32%, 30%, and 27% of their market, proof the E-commerce in the car industry has way space to grow.

And their ideology work. 400+ dealers are already transacting, with a goal of 1,000 and have 261 originations with a target of 1,000 by year end. Another proof their vision is on the right path, PBX has as partners Allianz Partners, Motor Trend, Bryan Hunt and CB Auto.

Powerband doesn’t get just one stream revenue but several ones through subscriptions, license fees origination fees & gain on lease.

A Healthy Growth Through their DRIVRZ

Their revenues come from 3 derivatives of DRIVRZ:

DRIVRZfinancial

DRIVRZXchange

DRIVRZlane

Platform for dealers aimed at EV and all used vehicles leasing

Auction & sales platform that combines wholesales, retail and consumer sales into a single source.

Digital retail solution connecting consumers, dealers and finance sources online (target launch in Q3/21)

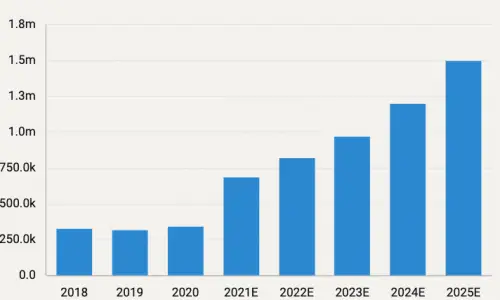

DRIVRZfinancial, which is currently deriving revenue from 562 dealer partners ( and which aims 1,000 by 1H/22), already has a two sequential months of 30% growth (June/July 21). As we mentioned earlier, this product is based for EV vehicles. With the world turning toward “green vehicles” and Biden’s politic to make half of new U.S. auto fleet electric by 2030, Powerband will have a great opportunity to take a stake of this green market. According to EVAdoption, The EV market will see a significant growth to reach 1.5M EV-cars sold for the year 2025.

To dig more on how Powerband extracts revenues through their products, we explain it for you:

DRIVRZfinancial

Transaction, gain on lease/sale of vehicles, other ( referral commission, rev share, data lisencing);

DRIVRZXchange

Transaction, gain on lease/sale of vehicles, other ( referral commission, rev share, data lisencing);

DRIVRZlane

Transaction, SAAS/Subscription, other ( referral commission, rev share, data lisencing).

Powerband isn’t the only one in this sector but with their product DRIVRZ, the company has many qualities compared to their competitors:

-VROOM cannot support consumer listings and doesn’t offer used vehicles leasing;

-CARVANA is limited to seel because of its inventory, cannot sell both new and used and doesn’t offer used vehicles leasing;

-CARLOTZ is a high fee for retail business and doesn’t offer used vehicles leasing

Good Fundamentals

Growth

Let’s back all these words with numbers for a proof that Powerband is moving forward and upward. According to their last Quarter Report, the numbers are astonishing. PBX reported an adjusted EBITDA loss in the second quarter of 2021 which was reduced by 48% relative to the first quarter of 2021. Moreover, they have reported a year-to-date 2021 revenues of $7.6M, an increase of 151% when compared to full twelve months 2020 revenues of $3.0M. They have $2,336,032 compared to $1,403,213 as at December 31, 2020 + $12,775,901 from a Private Placement.

Fundamentals

Talking about fundamentals, Powerband has a 20.90 Price/Sales ratio. It can seem overvalued at first look but the P/S ratio is higher in the tech sector as investors eye fast growth. The % held by insiders is around 50%. It is very rare, only few companies can boast to have this high number (a company with 20% held by insiders is already considered as strong). With a 113.34M shares float and 700,000 average volume, you could see significant movements as proved the recent moves.

CONCLUSION

Powerband has the right product, the correct management, and good fundamentals. With the current environmental political decisions, and the changings into consumer’s spending with the E-commerce, Powerband should have a healthy growth and could make their investors happy in the future. This is why you could buy PBX stock and if not, add it to your watchlist.

This article solely expresses the opinion of the writer which might be disagreeing with the other writers of Money,eh?

powerband stock powerband stock powerband stock powerband stock powerband stock powerband stock powerband stock powerband stock powerband stock powerband stock powerband stock